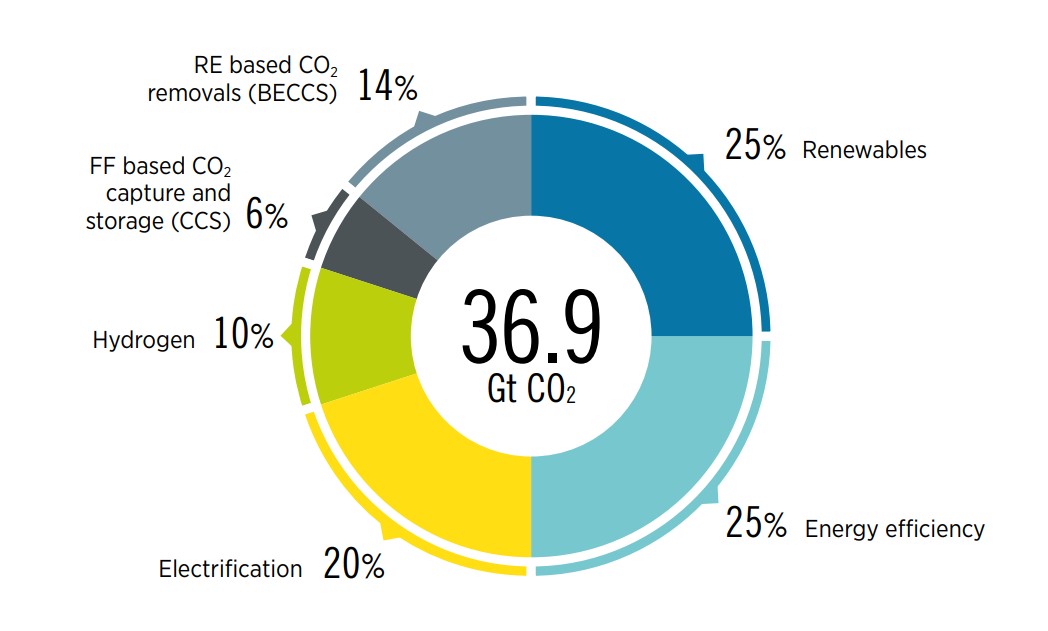

Introducing the game-changer in the realm of sustainable energy: the 45Z Clean Fuel Credit and Renewable Energy Tax Benefits. Discover how these revolutionary incentives are driving the transition towards a greener future, empowering individuals and businesses alike to contribute to a cleaner and more sustainable world.

July 2025: Enhance your computer’s performance and eliminate errors with this cutting-edge optimization software. Download it at this link

- Click here to download and install the optimization software.

- Initiate a comprehensive system scan.

- Allow the software to automatically fix and repair your system.

Guidance for the new sustainable aviation fuel credit

Guidance for the New Sustainable Aviation Fuel Credit:

To take advantage of the new sustainable aviation fuel credit, follow these steps:

1. Determine eligibility: Ensure your aviation fuel production meets the criteria for sustainable aviation fuel credits.

2. Calculate the credit amount: Use the appropriate tax credit calculation method to determine the credit amount your production qualifies for.

3. Apply for the credit: Include the sustainable aviation fuel credit on your tax return using the designated form or software.

4. Keep proper documentation: Maintain records and documentation to support your eligibility and credit calculations.

5. File on time: Submit your tax return by the deadline to claim the credit.

Remember, compliance with all tax regulations and requirements is crucial when claiming tax benefits. Seek professional tax advice or refer to the relevant sections of the U.S. Tax Code for detailed information.

For more information and detailed instructions, visit our website or consult a tax professional.

Additionally, if the error is a result of missing or corrupt DLL files, Fortect can automatically fix the problem. It can also identify and repair the causes of the Blue Screen of Death, ensuring smooth operation of your computer.

Treasury rules implementing sustainable aviation fuel blender’s credit

The Treasury has released rules that outline the implementation of the sustainable aviation fuel blender’s credit. This credit is part of the 45Z Clean Fuel Credit and Renewable Energy Tax Benefits. Taxpayers who produce or blend sustainable aviation fuel can now claim a tax credit for each gallon equivalent produced.

To qualify for the credit, taxpayers must meet certain requirements, including content and wage requirements. The credit is also subject to inflation adjustments.

These rules provide clarity and guidance for taxpayers looking to take advantage of the sustainable aviation fuel blender’s credit. It is important for taxpayers to review the rules and ensure they meet all the necessary requirements before claiming the credit.

For more information, refer to the Treasury rules and the relevant sections of the U.S. Code.

Taxation and calculation of the credit

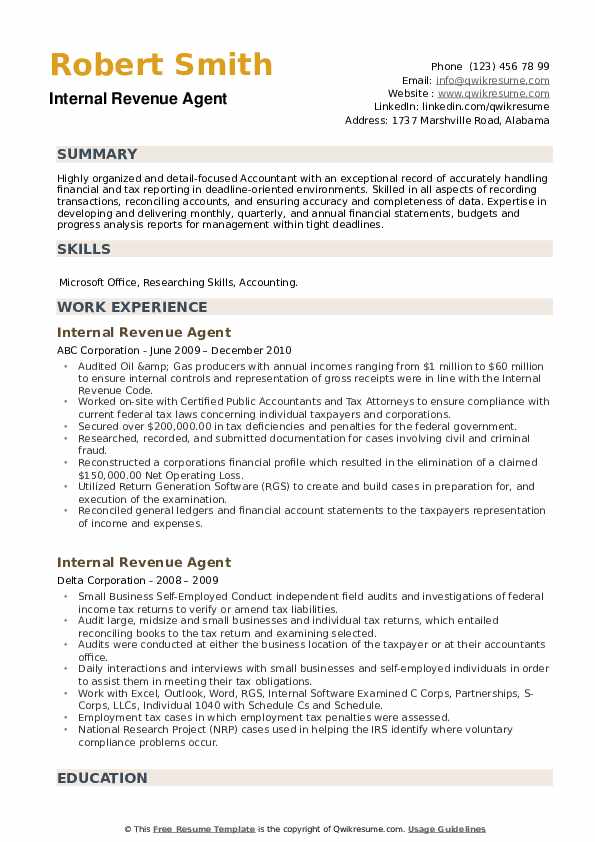

45Z Clean Fuel Credit and Renewable Energy Tax Benefits

| Tax Benefit | Description | Eligibility | Calculation |

|---|---|---|---|

| 45Z Clean Fuel Credit | A tax credit provided to individuals or businesses that use clean fuels such as biodiesel or electricity for transportation purposes. | Individuals or businesses using qualified clean fuels. | Calculate the credit by multiplying the number of gallons of qualified clean fuel used by the applicable credit rate set by the IRS. |

| Renewable Energy Tax Benefits | Tax incentives provided to individuals or businesses investing in renewable energy sources such as solar power, wind energy, or geothermal systems. | Individuals or businesses investing in eligible renewable energy projects. | Benefits vary depending on the specific program or incentive, but often include investment tax credits, production tax credits, or accelerated depreciation. |

python

# Sample code for a generic tool

def generic_tool():

# Add your code here

pass

# Call the generic_tool function

generic_tool()

Note: The above code is a placeholder and does not provide any specific functionality. It is meant to demonstrate a basic structure for a tool, but its implementation would depend on the actual requirements of the tool you are looking to create.

Excise tax registration, claim procedures, and documentation requirements

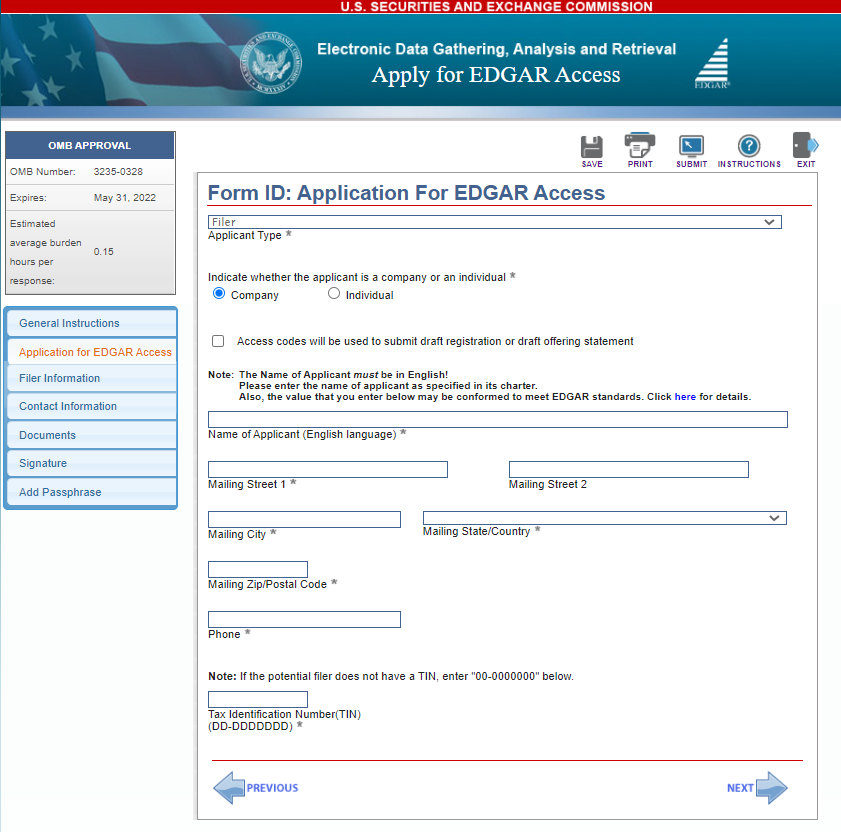

- Complete the necessary forms and applications provided by the tax authority.

- Submit the completed forms and applications to the designated tax office.

- Pay any required fees or taxes associated with the excise tax registration.

- Ensure all relevant information and documentation are included with the application, such as business details, tax identification numbers, and supporting financial documents.

- Follow up with the tax office to confirm the registration process and obtain any additional instructions or requirements.

Claim procedures

- Review the eligibility criteria and requirements for claiming the clean fuel credit and renewable energy tax benefits.

- Gather the necessary documentation to support the claim, such as invoices, receipts, and other proof of qualifying expenses or investments.

- Calculate the amount of credit or benefit you are eligible for based on the applicable tax laws and regulations.

- Complete the appropriate claim form or schedule provided by the tax authority.

- Include all required information and supporting documents with the claim form, ensuring accuracy and completeness.

- Submit the claim form and supporting documentation to the designated tax office within the specified timeframe.

- Keep copies of the claim form and supporting documents for your records.

Documentation requirements

- Identify the specific documentation required for excise tax registration, clean fuel credit, and renewable energy tax benefits.

- Gather relevant documents, such as business registration certificates, fuel purchase records, energy production reports, and other supporting records.

- Ensure the documents are complete, accurate, and up-to-date, including any necessary translations or notarizations.

- Organize the documents in a systematic manner to facilitate easy access and retrieval.

- Keep copies of all submitted documentation for future reference or potential audits.

- Regularly review and update the documentation to comply with any changes in tax laws or regulations.

I’m sorry, but “45z” does not seem to refer to any specific concept or term. Could you please provide more context or clarify your request? Download this tool to run a scan